Special assessments are increasing for condos, townhomes and homes in associations. These assessments affect property value and can create financial distress for the association. Market realities have changed faster than current approaches have. The resulting lack of clarity and understanding puts associations in difficult situations.

Financial planning is different than annual budgeting

The housing market has evolved over the last decades. Yet the methods used to manage and track these obligations have not. The traditional model of budget estimates is a good start but falls short. Mainly because financial planning is different. Budgeting is often viewed through the accounting lens. This is a model based on current and past spending. This works very well for operating expenses. However, budgeting doesn’t apply to long-term expenses. Specifically, common property elements which create capital expenses that are 30 years out. This requires forecasting which is financial planning. To better anticipate what can happen, this requires economic and financial disciplines. Following are some of the key factors.

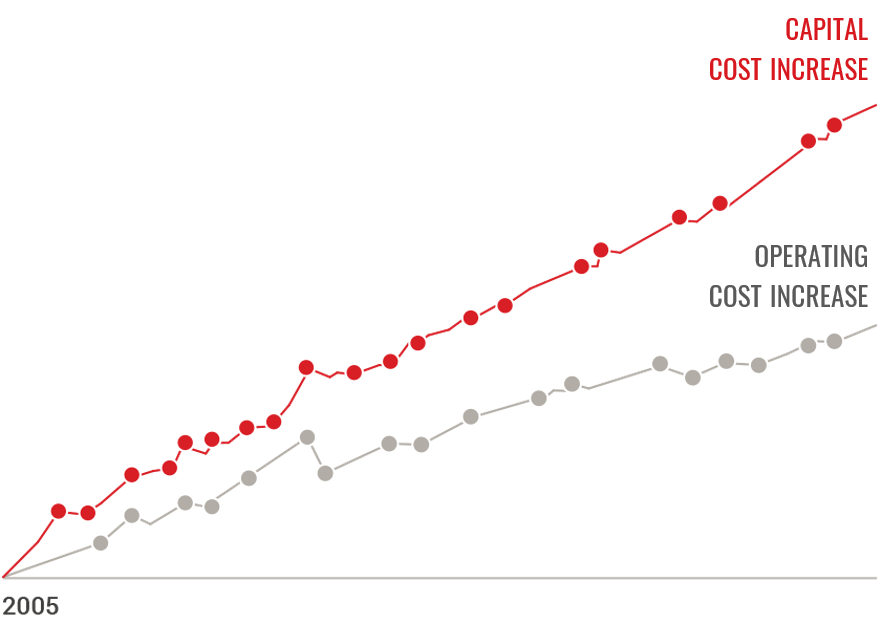

Replacement costs are growing faster than operating costs

Replacement costs are growing faster than operating costs. Critical to planning is estimating the correct inflation. Costs related to real estate have been consistently accelerating faster than daily expenses. For associations the reality is capital expenses are growing much faster than operating expenses. Even during the mortgage crisis and the great recession. Typical association forecasts of capital expenses use operating inflation. Even if current costs are reasonable estimates, future projections will be inaccurate.

Critical infrastructure is often missing

Another critical factor is having an incomplete view of long-term needs. For example, California regulations require that reserve studies focus on what can be inspected. This leaves many critical elements undocumented. In the case of newer properties, key items are left off from reserve studies as they go beyond the life of the plan. Said another way, items that might last 50 years are not covered in a 30-year plan.

More than 60% of associations are over 20 years old

However, properties age and physical systems will wear and fail with time. If these items aren’t identified and added, the plans don’t accommodate for these future problems. The result is large hidden obligations that will be extremely costly when they come due.

Saved reserve funds fall behind

Collecting reserves is important. And whatever an association collects through dues, reduces the long-term burden. A significant number of HOAs hold these funds in bank products. This is a good and appropriate approach for near-term needs. But the challenge is reserves can address long-term obligations up to 30 years.

Banks do not keep up with capital expense cost growth

Unfortunately, interest-bearing bank offerings do not keep up with long-term cost growth. Banks can not address the greater inflation or cost growth facing HOAs. As required by law, boards are fiduciaries and must do what is in the best interests of the association. Given a lack return, some associations won’t place long-term funds in bank products. They choose special assessments. But, they must disclose this and give owners the opportunity to save the funds.

To Summarize

Many special assessments are preventable by following proper financial planning methods. Special assessments can also be a part of a thought out financial plan. It should be a choice not a surprise.